Cheers and Jitters!

- Vipul Arora

- Jul 11

- 3 min read

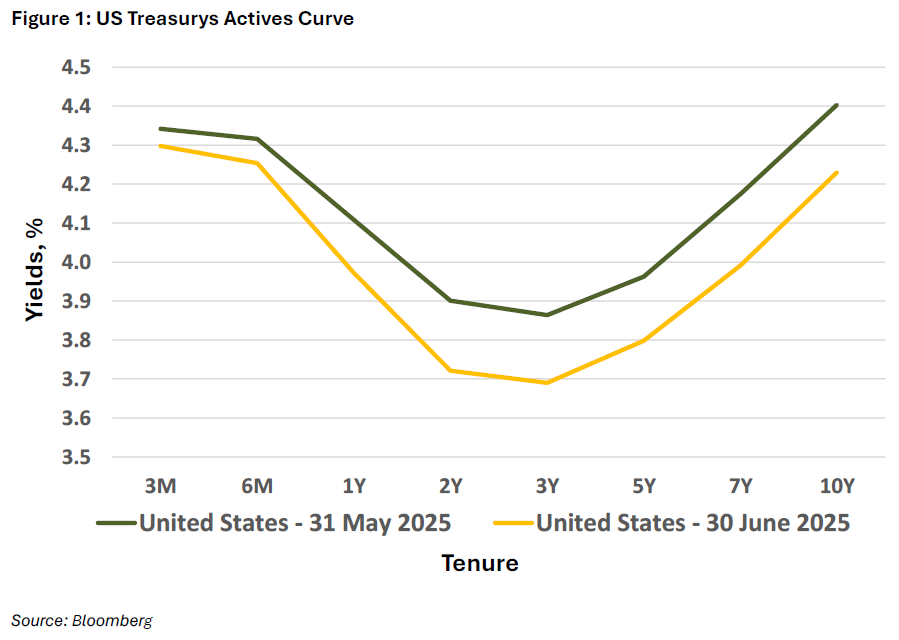

North American capital markets witnessed continued optimism from the equity investors on the back of progress on the trade talks while the skepticism of fixed income investors was visible in the choppy price action during the month of June. The S&P 500 Index and the S&P TSX Index were both in green for the month while aggregate fixed income index was flat in Canada and green in the United States. The change in tone of the Trump administration from escalating rhetoric on tariffs to telegraphing that several deals with trading partners are underway with good progress being made in discussions helped alleviate the concerns in equities markets. The reports of softer economic data in the United States led to an increase in expectations of policy rates cuts sooner than later despite the continued caution in the tone of the Federal Reserve bank. The bond yields in the United States dropped by ~16-to-17 basis points across the 2-year-to-10-year tenures of the yield curve (see Figure 1). On the other hand, the bond yields in Canada advanced by ~0-to-8 basis points across the 2-year-to-10-year tenures on the yield curve (see Figure 2).

Figure 2: Canada Sovereign Curve

We think the biggest relief the markets received during the month was the progress made on the trade talks, especially with China. Early on during the month, the news flow of constructive trade talks with China led to a restart of rare earth minerals exports to the United States, and eventually, an announcement that an understanding has been reached with China on the trade framework lifted market sentiment, in our opinion. In early July, United States also eased restrictions on export of chip design software to China. The optimism around trade was more than sufficient for equity markets to shrug off the risks from escalating tensions in the middle east and continued caution cited by the central banks.

The Federal Reserve and the Bank of Canada both decided to keep policy rates at +4.50% and 2.75%; respectively. The Federal Reserve chair, Jerome Powell, stated that there is too much uncertainty around the impact of tariffs and immigration policy on inflation and unemployment rate; however, given that the economic data is benign for now, the Fed can afford to wait before making any decisions. The Bank of Canada’s governor, Tiff Macklem, also stated uncertainty around the United States trade policy in the backdrop of a somewhat softer economy and a firming up of inflation as reasons for the decision to stay put.

The ‘One Big Beautiful Bill Act’ was signed into law on July 4th, 2025. As per the latest estimates of the Congressional Budget Office, the bill is expected to reduce expenditures by ~$1.2 trillion and reduce revenues by ~$4.4 trillion with a net effect of adding a deficit of ~$3.2 trillion over a period of next 10 years (2025-2034). The combination of higher interest rates along with increasing debt does not paint a good picture for United States’ fiscal situation. The United States’ President, Donald J. Trump, has been openly expressing his displeasure of the higher interest rates and criticizing the Fed chair, Jerome Powell, for holding the interest rates high for too long. The attacks add to the jitters of fixed income investors as they question what might be the consequence of Federal Reserve losing its independence when the United States’ fiscal situation and trajectory is not looking pretty. Nevertheless, we also note that the messaging from the Trump administration has changed to that they have realized the path of growing the economy out of debt burden is perhaps a more reasonable way rather than expenditure cuts, which will impact economic growth adversely.

Looking ahead, we think incremental softening of economic data in North America will increase the pressure on central banks to ease the monetary policy and therefore supportive of markets. If inflation remains under control, the case for central banks to keep policy rates on pause will get weaker. We also think the market volatility driven by erratic nature of policy making from Trump administration will remain elevated. However, provided that no substantially damaging policy is announced and implemented, markets should adapt and refocus on economic fundamentals.

Sources: Bank of Canada, US Federal Reserve, Congressional Budget Office and Bloomberg

Vipul Arora is a Portfolio Manager with Assante Capital Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. Please contact him at 613-258-1997 or visit ofarrellwealth.com to discuss your particular circumstances prior to acting on the information above. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. Insurance products and services are provided through Assante Estate and Insurance Services Inc.

Comments