Selectivity to Navigate Uncertainty

- Vipul Arora

- Dec 17, 2025

- 3 min read

North American capital markets have been witnessing choppy markets since the beginning of November as investors moved from one concern to another in a short span of time. From worries around impact of extended government shutdown on the state of the economy to if the United States Federal Reserve delivered a rate cut on December 10th, the date for Federal Open Market Committee (FOMC) meeting, to if the extent of capital expenditure done to build the artificial intelligence infrastructure will eventually yield results for companies have kept investors on toes. Any company taking on leverage to build out artificial intelligence infrastructure has been punished. In addition, any company across the artificial intelligence value chain failing to even slightly meet the lofty investor expectations has been met with increasing scepticism in the recent weeks.

We do not doubt the transformational power of the technology and think the value will become more apparent as the industry and technology matures over time and starts to showcase more use cases and productivity benefits. That said, we think the markets will begin to differentiate between artificial intelligence winners and losers in 2026. Given the major players put on this litmus test are also the heavy weights in the indices; the choppiness at the index level is more likely to continue, in our view.

Further, the recent weeks have also seen rotation away from the heavy weights to the laggards in the index. The broadening of markets is generally a good sign for the bulls. That said, for the index laggards to continue to play catch-up they will also have to demonstrate earnings growth. Declining interest rates could help to bring the interest expenses down; however, the ability to pass on the tariffs will differentiate between companies’ ability to protect margins. Tariffs have largely stayed in place and thus far companies have largely decided to not pass on tariffs to customers in expectations of a resolution. Going forward, this is likely to change as many companies reach their limits to not pass on the tariffs. Even if the Supreme Court rules tariffs as illegal, the Trump administration will try to figure out other ways to collect levies. This will keep policy uncertainty elevated.

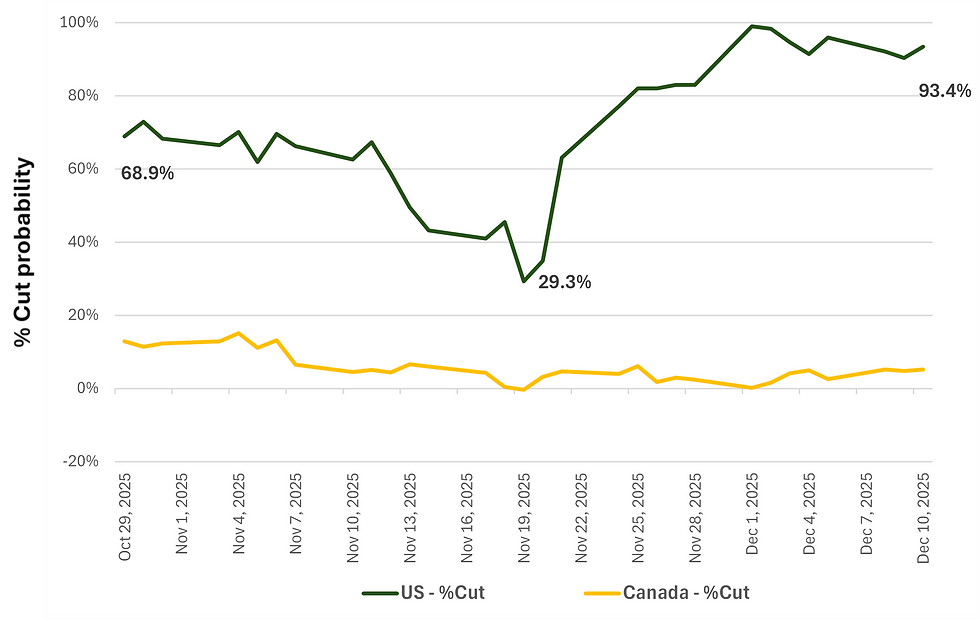

Another dynamic keeping policy uncertainty elevated is guidance from the Central Banks. On the 10th of December, the Bank of Canada kept policy rates unchanged at 2.25% and guided to hold rates steady in line with market expectations. The United States Federal Reserve delivered a 25 basis-points cut on December 10th, also in line with expectations, however, market expectations witnessed unusually large variations from the 29th of October (the previous meeting and guidance date) to the 10th of December (See Figure 1) (from ~68.9% on October 29, 2025 to ~29.3% on November 19th, 2025 and then back to 93.4% on 10th December 2025). In other words, the markets are anticipating higher policy uncertainty in the United States as relative to Canada.

Figure 1: %Cut implied by Fed Funds Futures (US) and Overnight Index Swaps (Canada)

Source: Bloomberg

Overall, we think selectivity will be the key to navigate the uncertain set-up of 2026. Leaning on the recent trends in markets, the ability of laggard companies to meet expectations of earnings growth and the ability of the companies in the artificial intelligence value chain to demonstrate tangible value amid the uncertain policy backdrop will differentiate between winners and losers in 2026, in our view.

Vipul Arora is a Portfolio Manager with Assante Capital Management Ltd. The opinions expressed are those of the author and not necessarily those of Assante Capital Management Ltd. Please contact him at 613-258-1997 or visit ofarrellwealth.com to discuss your circumstances prior to acting on the information above. Assante Capital Management Ltd. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization. Insurance products and services are provided through Assante Estate and Insurance Services Inc

Comments