Mr. Bond gets Trumped

- Vipul Arora

- Nov 12, 2024

- 3 min read

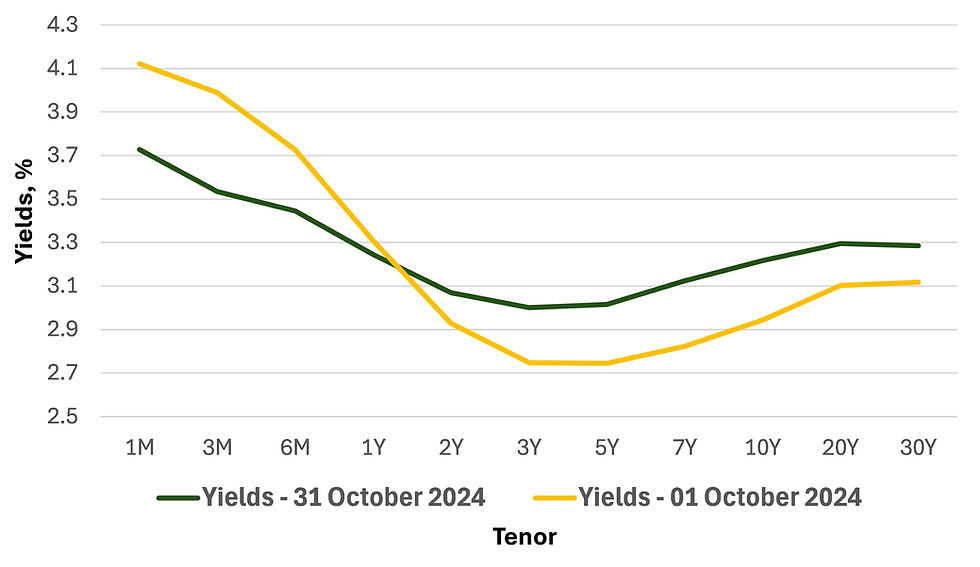

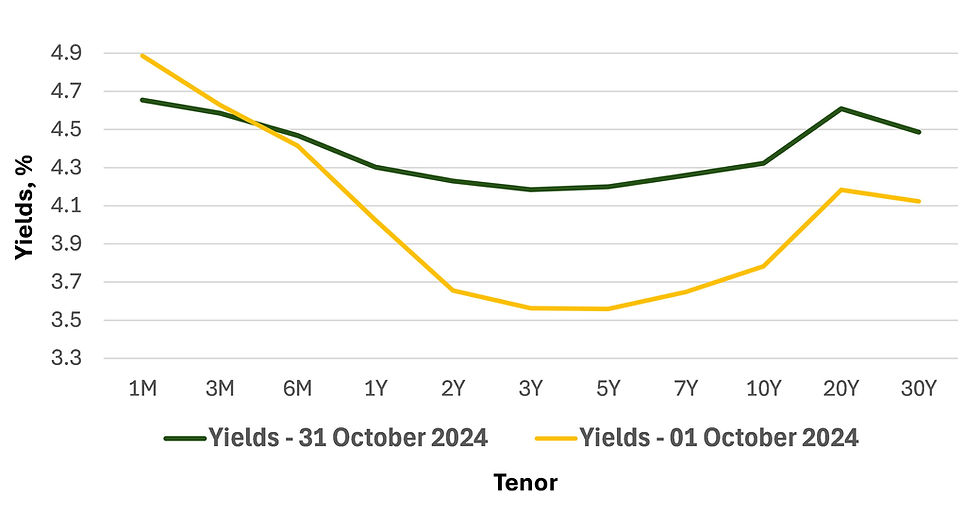

In our previous update, we highlighted the investors dilemma of whether there could be two or three rates cuts before the year-end. The month of October tilted the debate in favor of only two rate cuts with one 25 basis-points cut already delivered by the United States Federal Reserve on the 7th of November. The Bank of Canada’s rate decision was announced on October 23rd , and it delivered a 50 basis-points cut in line with expectations. Despite the announced policy rate cuts which are positive for the fixed income asset class; the bond investors were in red for the month on both sides of the border. The yield curves in Canada and the United States shifted upwards as investors dialed back expectations of the number of rate cuts and baked in a slower path to inflation normalization. (See Figure 1 and 2)

Figure 1: Canada Sovereign Curve

Source: Bloomberg

Figure 2: US Treasury Actives Curve

Source: Bloomberg

The United States presidential elections were top of mind of investors across the globe given the difference between policies announced by the Republican and Democrat candidates. Trump presidency was being viewed by markets as relatively more inflationary as telegraphed intentions of tariffs on imports put together with promises of tax rate cuts translated into simultaneous increases in supply bottlenecks and a stimulus that could increase demand. Though the exit polls were showing a close contest; the financial markets traded on expectations of a Republican win as evident from the rise in bond yields, in our view. In addition, better-than-expected economic data also corroborated to support the move in bond yields.

In Canada, the headline inflation dropped to +1.6% in September (reported in October) from +2.0% in August (reported in September). This was below the expected number of +1.8% for September. In the United States, the headline inflation was at +2.4% for September (reported in October); lower than +2.5% in August (reported in September), but higher than expected +2.3%. The unemployment rate in Canada dropped to +6.5% in September (reported in October) from +6.6% in August (reported in September). In the United States, the unemployment rate dropped to +4.1% in September (reported in October) from +4.2% in August (reported in September). ISM Manufacturing PMI (Purchasing Manager’s Index) in the United States was flat at +47.2 in September (reported in October), however, ISM Services PMI jumped to +54.9 in September (reported in October) from +51.5 in August (reported in September).

We expect the volatility in bond yields to remain elevated as investors dissect every datapoint with a read through on inflation or policy rates trajectory. The tensions between the Federal Reserve Chair, Jerome Powell, and President-Elect, Donald Trump, have been well known. During the press briefing after the latest FOMC (Federal Open Market Committee) meeting, the United States Fed chair, Jerome Powell, replied with a brief ‘No’ to a question that asked if he would resign should the new President ask him to do so. While we think it is unlikely the President-Elect, Donald Trump, would like to disrupt the Federal Reserve and undermine the progress made on inflation so far, any rhetoric on this front could bring short-term volatility to the broader markets, in our opinion. Resilient economic data put together with supportive central bank policies and benign inflationary pressures for now keep us constructive on the outlook. We think this backdrop continues to make a strong case for investment in risk assets despite stretched valuations.

Comments