In Limbo

- Vipul Arora

- May 8, 2022

- 3 min read

Updated: May 26, 2022

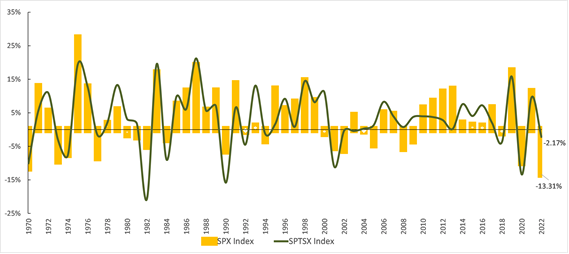

In general, April is considered a strong month in the markets. Since 1970, April performance of the S&P 500 Index has yielded positive price returns ~70% of the time and the S&P TSX Index has yielded positive price returns ~60% of the time. April 2022, however, struggled as the S&P 500 Index and the S&P TSX Index price returns came in at ~-8.7% and ~-5.2%, respectively.

As of April 30th, the drawdown of ~13.31% showing on the S&P 500 is most like the decline of -11.45% in 1970 (Chart 1). Comparatively, the S&P TSX Index fared better with a price decline of -2.17%. The drawdown in bond markets also set records with measures of aggregate bond markets declining by ~9.9% in the US and ~9.5% in Canada. These are the worst recorded declines since 1976 for the US (The Bloomberg US Aggregate Bond Index) and since 2002 for Canada (Bloomberg Canada Aggregate Total Return Index Unhedged CAD) (See Chart 2).

Chart 1

S&P 500 Index and S&P TSX Performance (January to April)

Source: Bloomberg

Chart 2 US and Canada - Aggregate Bond Market Performance (January-to-April)

Source: Bloomberg

In April, bond markets continued to aggressively price against expectations of large interest rate hikes. The 10-year bond yields jumped by ~60 basis points in the US and by ~46 basis points in Canada after inflation numbers came ahead of expectations at +8.5% in the US and +6.7% in Canada. The reaction from bond markets indicates that the fixed income traders believe that Central Banks are behind the curve on controlling inflation, and therefore, will be forced to slam the brakes on the economy by delivering high interest rate hikes at a faster rate.

On the other hand, equity market investors seemed to have taken a relatively benign view of the inflation narrative, up until a couple of developments later in the month. First, a report* on April 20 showed inflation in Canada blew past expectations. Second, the US Fed Chair, Jerome Powell, stated on April 21, that front-loading rate hikes by increasing interest rates by 50 basis points in May would be appropriate. The above developments were followed by comments from certain Fed officials indicating the prospect of a supersized 75 basis points could also be entertained.

The volatility in equity markets was exacerbated during the last two weeks of the month as the above developments provided fuel to the narrative that inflation is becoming more persistent. Also, the Central banks have been pushed into a corner where the only way out of the situation is to aggressively hike interest rates which may lead the economy towards a recession.

While equity markets are always dealing with some form of uncertainty, the factors mentioned below make the current situation somewhat unique:

The war in Ukraine is at a point where no simple solution is in sight.

The prospects of a ban on Russian energy supplies and the extent of its impact on the European economy.

Incremental inflationary pressures as China, the World’s manufacturing factory, locks down again to deal with the threat of a new wave of Covid-19.

The unprecedented stimulus measures during the pandemic and the subsequent impact of its unwinding.

We believe that all the above factors could influence inflation and thus the inflation narrative is the most important variable to watch. The unpredictability of the above factors lies in estimating the extent of their contribution to inflationary pressures and the Central Banks’ policy response.

Thus far, the equity markets’ reaction is aligning with historical precedence where equity markets initially look for direction (expressed with an increase in volatility) at the start of the interest rate hikes cycle and then realign and adjust after the policy path becomes clear. Since the policy path is dependent upon the inflation trajectory, equity market volatility may be here to stay until the inflation rate starts to level off or even better, soften in the coming months. As supply chain pressures ease and the World economy moves forward, a shift in consumer spending from goods to services suggests such a scenario is not impossible.

*Statistics Canada

Comments